Travelers Insurance Flight Delay – Overnight Stay

Alright, let’s talk about making a claim with your insurance because of a travel delay. First things first, let me express my sincerest apologies for the hassle you’re going through, but I’m glad you have travelers insurance to help save the day!

Sending you sorrows, sorrows, and prayers.

It is important to note that I am going off of my personal past experiences and giving what the process has been for me in the past. While I can provide valuable advice and opinions, it’s essential to clarify that I am not a certified claims adjuster.

Regardless if you have an individual trip, annual policy, or you’re using a credit card for coverage, you need to start with the steps:

- Get Proof of Your Roundtrip Travel: You need to have evidence of your roundtrip travel from your home city to submit. Annual policies only cover you for a certain number of days away from home. In regards to the two annual policies I sell, RoamRight is 30 days with Allianz it is either 45 or 90 days depending on the policy. Even if you have a single trip policy you will still need this proof of travel for your claim.

- Document Necessary Expenses: During the delay, keep a record of all your necessary expenses. We’re talking taxi fares, hotel charges, food, and toiletries. And if your bags decide to go on their own adventure and you need toiletries for the evening make sure you save the receipt. If buying personal items put those on a separate transaction for simplification. If your hotel is nowhere near a store you can Instacart those essentials.

- Save all emails from the airline informing of delays and rebooking for documentation, you might need them to support your claim.

- Before you start day dreaming about booking a swanky suite at the Four Seasons (presumably booked by me to earn that commission and get you extra benefits) and living your delayed White Lotus fantasy, make sure you check out your policy coverages. All the information about your coverages was sent to you with your confirmation email. While I am here to help answer your questions, your coverage and documentation is in your email inbox, waiting for you to read it.

- For annual policies, the standard delay coverage is $200 per day. If you’re relying solely on credit card travel delay coverage, the average coverage is $500 per incident. But listen up, if you don’t have a credit card that offers travel delay coverage, you need one. Trust me, it’s a game-changer. And if you need a referral link ask me for one, I would love a referral bonus. If you are going to rely on your credit card coverage make sure you read the cards benefit guide to make sure you are following the right procedures to be covered.

- Prepaid Hotel Expenses: If you had prepaid hotel expenses or missed a night due to the delay, hold onto that hotel folio and the booking confirmation. Write a letter to the hotel asking them to waive that prepaid night or the first night’s charges. If they deny you, save that response as a document because you are going to need that as evidence for your compensation.

- Contact the Common Carrier and request compensation: Reach out to the common carrier and request compensation for all the necessary expenses you had during that delay. They’re going to approve or deny your claim, and you’ll need their response letter to show your travelers insurance provider to process a payment to you. When you’re writing to the airline to ask for compensation make sure to inquire and ask them to respond with the cause of the delay. These can be things related to weather, mechanical issues, or crew mishaps. Having this information writing lets the insurance company know it wasn’t your negligence, and that the delay was out of your control. But remember, keep the compensation request letter simple and classy. Leave out unnecessary emotions like “My vacation was ruined” or “This was the worst experience ever.” Trust me, they won’t give you any extra compensation besides an eye roll from the representative while they copy and paste a standard response.

- Finally be ready for “Additional Documentation Requests”. Be prepared because even when you’ve supplied every document they asked for online, they’re gonna come back asking for more. It’s like a never-ending story, but be vigilant and follow up with any additional information requested. Do not let them forget about your claim. Eventually, they’ll cough up that coin and make it right for you.

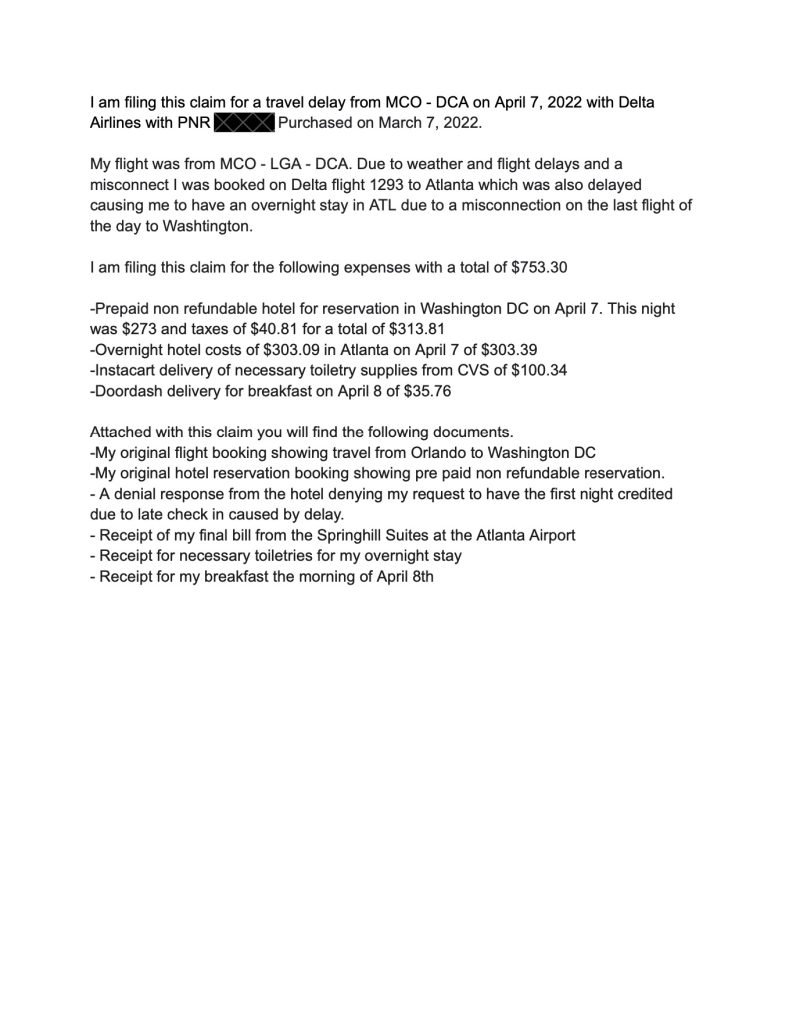

Below you will see a delay letter I composed for Delta to reference on how to contact the common carrier. Delta covered everything in this situation even though it was a weather delay, so I didn’t have to submit it to my annual policy, but you can still use it as a template to guide you in writing a similar letter.

Message me any time, I am here to help!